Energy is of huge importance for the growth of the economy. The demand is steadily growing and the political change away from nuclear power to renewable energy slows the supply growth of energy. I screened stocks from the investment theme by the best growth over the past 10 years. I decided to select only stocks with a double-digit sales growth and a dividend yield of more than three percent. Fourteen stocks fulfilled my criteria. The highest growth was realized by Penn Virginia Resource Partners (PVR) who had a yearly growth of 40.3 percent. One company has a yield of more than 50 percent.

Here are my favorite stocks:

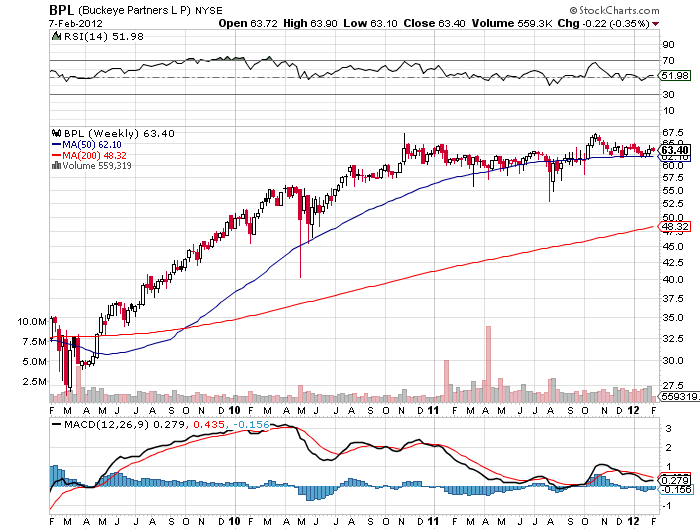

1. Buckeye Partners (BPL) has a market capitalization of $5.89 billion. The company employs 859 people, generates revenues of $3,151.27 million and has a net income of $43.08 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $338.70 million. Because of these figures, the EBITDA margin is 10.75 percent (operating margin 8.87 percent and the net profit margin finally 1.37 percent).

The total debt representing 50.51 percent of the company’s assets and the total debt in relation to the equity amounts to 129.65 percent. Due to the financial situation, a return on equity of 5.27 percent was realized. Twelve trailing months earnings per share reached a value of $0.80. Last fiscal year, the company paid $3.82 in form of dividends to shareholders.

Here are the price ratios of the company: The P/E ratio is 79.04, Price/Sales 1.88 and Price/Book ratio 3.26. Dividend Yield: 6.44 percent. The beta ratio is 0.26.

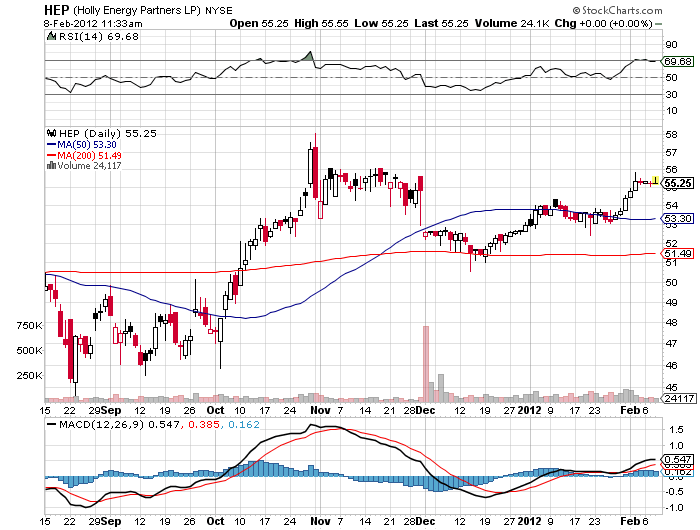

2. Holly Energy Partners (HEP) has a market capitalization of $1.22 billion. The company employs 148 people, generates revenues of $182.10 million and has a net income of $58.87 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $121.35 million. Because of these figures, the EBITDA margin is 66.64 percent (operating margin 49.84 percent and the net profit margin finally 32.33 percent).

The total debt representing 76.43 percent of the company’s assets and the total debt in relation to the equity amounts to 449.52 percent. Due to the financial situation, a return on equity of 17.33 percent was realized. Twelve trailing months earnings per share reached a value of $2.47. Last fiscal year, the company paid $3.32 in form of dividends to shareholders.

Here are the price ratios of the company: The P/E ratio is 22.39, Price/Sales 8.30 and Price/Book ratio 4.86. Dividend Yield: 6.41 percent. The beta ratio is 0.65.

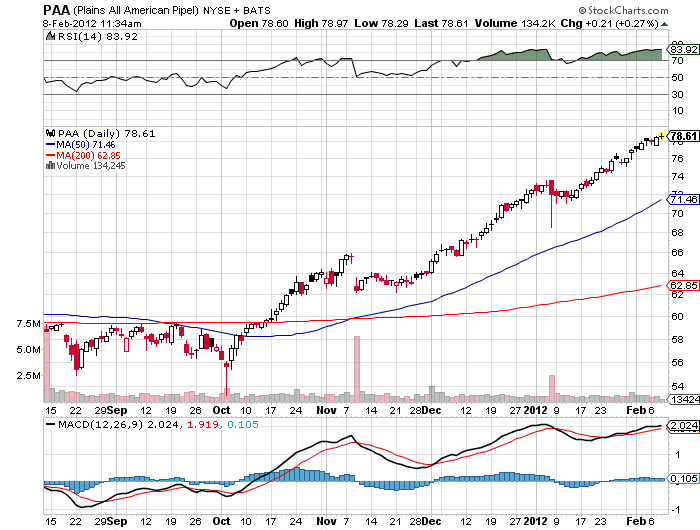

3. Plains All American Pipelines (PAA) has a market capitalization of $11.65 billion. The company employs 3,500 people, generates revenues of $25,893.00 million and has a net income of $514.00 million. The firm’s earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $1,016.00 million. Because of these figures, the EBITDA margin is 3.92 percent (operating margin 2.96 percent and the net profit margin finally 1.99 percent).

The total debt representing 43.47 percent of the company’s assets and the total debt in relation to the equity amounts to 137.19 percent. Due to the financial situation, a return on equity of 8.01 percent was realized. Twelve trailing months earnings per share reached a value of $4.18. Last fiscal year, the company paid $3.76 in form of dividends to shareholders.

Here are the price ratios of the company: The P/E ratio is 18.64, Price/Sales 0.47 and Price/Book ratio 2.60. Dividend Yield: 5.25 percent. The beta ratio is 0.50.

Take a closer look at the full table of energy stocks with fastest growth and big dividends. The average price to earnings ratio (P/E ratio) amounts to 20.95. The dividend yield has a value of 9.02 percent. Price to book ratio is 2.70 and price to sales ratio 2.88. The operating margin amounts to 26.35 percent.

Related stock ticker symbols:

ARLP, BPT, BPL, HEP, MMP, MMLP, PGH, PVR, PTR, PBR, PAA, RES, TGS, YZC