World Economic Outlook

World Economic Outlook

The International Monetary Fund (IMF) published their most recent outlook for the global economy Tuesday. While most of the headlines covered the IMF’s relatively tame outlook, the report also warned investors about financial excess. From the IMF:

Easy financial conditions, and the resulting search for yield, could fuel financial excess. Markets may have underpriced risks by not fully internalizing the uncertainties around the global outlook. A larger-than-expected increase in U.S. long-term interest rates, geopolitical events, or major growth disappointments could trigger widespread disruption.

How Concerned Should We Be?

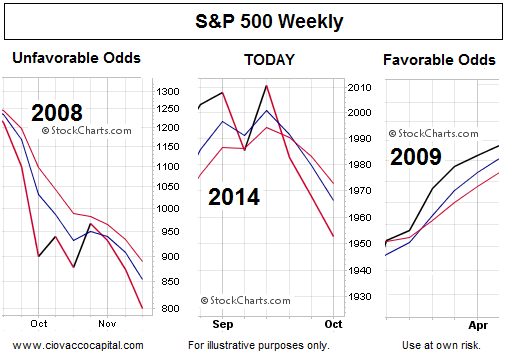

The charts below show the S&P 500 weekly during Tuesday’s session (middle), the S&P 500 in 2008 (left), and the S&P 500 in 2009 (right). While the market can find its footing at any time, the present day market is telling us to “pay closer attention to risk management” in the coming weeks. The charts below are described in more detail in a October 3 video clip.

Investment Implications – The Weight Of The Evidence

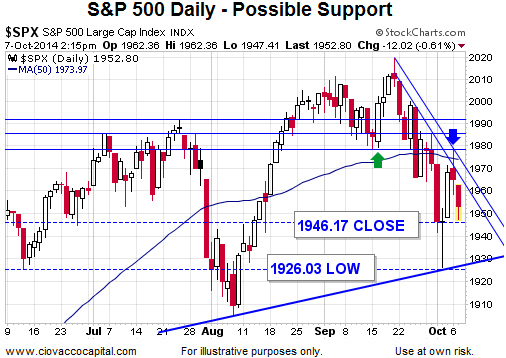

As noted in recent weeks, our market model has already called for a significant reduction in equity exposure based on the evidence we have in hand. Since it is not possible for stocks to drop for several weeks or several months without first taking out the S&P 500 levels shown below, we can use them as bull/bear guideposts in the coming sessions.

If the S&P 500 closes below last Thursday’s closing level of 1946, we will consider cutting our exposure to stocks (SPY) again. If the markets can respond favorably to the Fed minutes or Fed speakers this week, while remaining above 1946, we will try to exercise some “let’s see how things play out” patience.

About Chris Ciovacco

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC.