Private Capital is Increasingly Global and Diversified

Highlights

- Private capital allocation continues to increase in the Alternative Investment space, especially Real Estate. Higher degree of control, stable income producing properties, and diversification are contributing factors.

- Global Investor Capital is increasingly global, with 34% of planned future property investments being overseas.

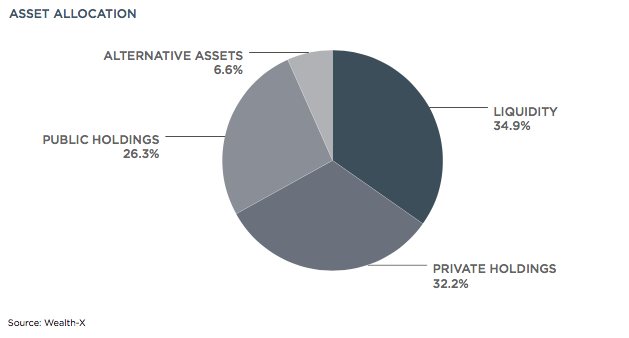

- Given uncertainty in the market, and difficulty in finding deals, private portfolios of wealthy individuals held 34.9% of their capital in cash or cash-like instruments in 2017.

Today’s investment arena is full of concerns surrounding geopolitical instability, trade wars, poor yields from bonds and record-high stock markets to name just a few. Everyone, from the small investor to the institutional behemoths, is scratching their heads over when is the next crisis, how do I preserve my capital, and so on.

A great exercise that helps to add clarity in these complicated times is to look at what the global Ultra High-Net-Worth Individuals (UHNWI) are doing with their large pool of available capital. What exactly are UHNWI doing with their money?

Two recent reports by Knight Frank (a UK-based luxury and investment real estate advisory firm) and Wealth-X (a US-based wealth research firm) provide some answers to that question.

The Wealthy’s Nest Egg

For starters, consider the wealth allocation of the UHNWI in 2017. According to Wealth-X, 34.9% of their total wealth are currently held in cash or cash-like instruments for liquidity. This is a clear reflection of the investment sentiment of our times. The longest stock market rally in history, extensive geopolitical turmoil, and the difficulty of finding good deal flow are making investors nervous. While markets have generally grown in the past year, uncertainty remains as UHNWI hold historically high levels of cash.

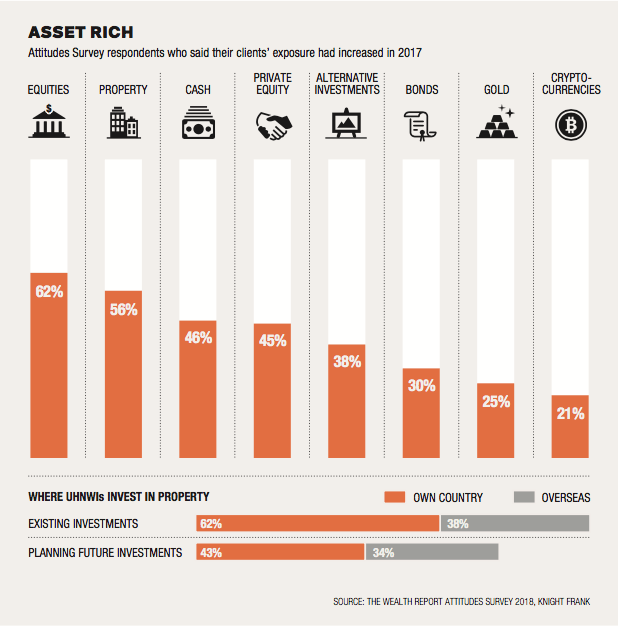

That does not mean, however, that billionaires are all cashing out completely and putting their holdings under their mattresses. A Knight Frank Attitudes Survey indicated where respondents’ wealthy clients are allocating their capital. The survey showed that 62% increased their exposure to public equities and 56% in investment property, ahead of a 46% increase in cash holdings. Respondents’ clients also increased their exposure in their portfolio to Private Equity to a tune of 45% and other Alternative Investments at 38%. Bonds, Gold and Crypto-Currencies saw only 21-30% of portfolios increase their exposure to these assets.

UHNWIs are also playing an increasingly important role in commercial real estate investments. Before, mainly institutional groups would play a part in investing in large properties in gateway markets and other large real estate projects. Now we observe that 2017 had private investors account for a third of all purchases: the highest proportion seen in over 10 years.

Why is there such an appetite for this asset class? The stable cash flow income, potential for capital growth and diversification that it offers are attractive benefits for the large portfolios of these individuals and family offices. In addition, direct investments in private real estate are an option that affords greater control over the risk profile, ownership structure, and business model of the investment.

“Commercial real estate remained a favoured asset class for global investors during 2017, with transaction volumes robust at US$840 Billion.” – Anthony Duggan, Knight Frank The Wealth Report 2018

Thus, in a low-yield environment this asset class looks extremely attractive. When trying to protect large portions of capital, settling for buying expensive stocks and low-yielding bonds and hoping that everything in the long-term makes money is not an effective strategy. As Rupert Edis, the Chief Executive of London-based Family Office JPS Finance puts it, “increasingly, to preserve capital you have to grow capital.”

And this strategy is not only about high yields. Many of the plays by UHNWI include a wider diversification not only through asset classes (through property investment or other alternative investments) but also geographically. According to the Knight Frank report, 34% of respondents’ clients plan to purchase investment property outside their home country compared to 45% of property investment within their home country. Hotspots continue to be the US and UK for foreign property investments, with 46% of capital allocated to North America followed closely by 36% in Europe, 17% in Asia, and 2% in other regions.

“Increasingly, to preserve capital you have to grow capital.” – Rupert Edis, Chief Executive of JPS Finance

What has been the impact of this increased appetite? In a hunt for deals, real estate investors have gone from purchasing Core Office buildings in Primary Markets (such as New York and London) to consider Value-Add and New Development projects in Secondary and Tertiary Markets as well. This includes a focus in specialty properties in the forms of logistics-related properties (warehousing and fulfilment centers), student housing, senior care, and medical offices. All of these sectors have seen healthy tenancy rates due to the growth in online retail, demand for college degrees, aging population, and growth in healthcare.

Lessons moving forward

What lessons can we learn from current global wealth trends? Every investor is particular in their own way, and thus it might mean something different depending on who is reading. Fundamentally, however, it should serve as a great reminder of two things.

First, cash continues to be king. In times of uncertainty, being in a more liquid position might decrease your current performance but it might also afford you excellent value opportunities in a turn-around when others are looking for investors in desperate times. Just read all of the stories about the calls Warren Buffet received during the 2008 crisis while he was sitting in large pools of cash. He was in a prime position to capitalize on a down market.

Second, diversification is a paramount tool for portfolio management. Whether within asset classes (e.g. industrial, office, etc. in real estate), across assets (real estate and public equities) or geographically, it is important to consider how your portfolio is safeguarded against all kinds of market fluctuations.

Whether you are a billion dollar Family Office or recently became an Accredited Investor, patience in thinking outside the box on diversification, and waiting with liquidity on hand for great opportunities might prove valuable lessons from the current UHNWI trends.

As the Swiss Philosopher Rousseau put it: “Patience is bitter, but its fruit is sweet.”

References:

Knight Frank, The Wealth Report 2018: The Global Perspective on Prime Property and Investment

Wealth-X, Ultra Wealthy Analysis: The World Ultra Wealth Report 2018

Sign-up for Hawkeye’s Newsletter for Market Updates, Upcoming Events & New Private Deals by clicking here