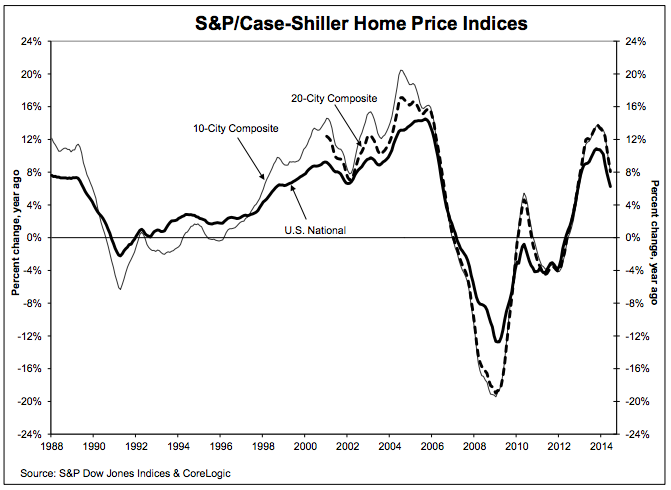

S&P’s Case-Shiller home price index have declined for the second-straight month.

June prices fell 0.2%, worse than the consensus estimate for no change, and even with the decline seen in May.

Year-over-year, prices climbed 8.1%, about in-line with forecasts but slower than a revised 9.4% gain for May.

The 20-city index hit 172.33, about in-line with forecasts and up from a revised 170.68 in June 2013.

“Home price gains continue to ease as they have since last fall,” David M. Blitzer, Chairman of

the Index Committee at S&P Dow Jones Indices, said in a release. “For the first time since February 2008, all cities showed lower annual rates than the previous month. Other housing indicators – starts, existing home sales and builders’ sentiment – are positive. Taken together, these point to a more normal housing

sector.”

Here’s what it’s looked like recently:

WIDESPREAD SLOWDOWN IN US HOME PRICE GAINS

S&P’s Case-Shiller home price index have declined for the second-straight month.

June prices fell 0.2%, worse than the consensus estimate for no change, and even with the decline seen in May.

Year-over-year, prices climbed 8.1%, about in-line with forecasts but slower than a revised 9.4% gain for May.

The 20-city index hit 172.33, about in-line with forecasts and up from a revised 170.68 in June 2013.

“Home price gains continue to ease as they have since last fall,” David M. Blitzer, Chairman of

the Index Committee at S&P Dow Jones Indices, said in a release. “For the first time since February 2008, all cities showed lower annual rates than the previous month. Other housing indicators – starts, existing home sales and builders’ sentiment – are positive. Taken together, these point to a more normal housing

sector.”

Here’s what it’s looked like recently: