Real Estate

Greater Vancouver home prices continued to soar in March, according to Real Estate Board of Greater Vancouver (REBGV) data released today.

The region’s benchmark home price rose to $1,360,500 in March, up 20.7 per cent from March 2021, and 3.6 per cent from February, according to the association that represents realtors and their companies.

Benchmark prices for all classes of home have been reaching new all-time highs in recent months. The region’s benchmark home price at the end of 2021 was $1,230,200.

“We’re still seeing upward pressure on prices across all housing categories in the region,” said REBGV chair Daniel John. “Lack of supply is driving this pressure.”

Sales for homes has slowed, but remains comparatively high.

Home owners transacted 4,344 sales in March, down 23.9 per cent from the record monthly high of 5,708 homes in March 2021. March’s sales total was 25.5 per cent higher than the 10-year average for that month.

New homes are being listed for sale, but less frequently than last year.

There were 6,673 detached, atttached and apartment properties listed for sale on the Multiple Listings Service in Metro Vancouver in 2022, according to the REBGV. That is 19.5 per cent down from the 8,287 homes listed for sale in March 2021, but 22 per cent more than the 5,471 homes listed for sale in February…read more.

The Fed is finally ready to roll

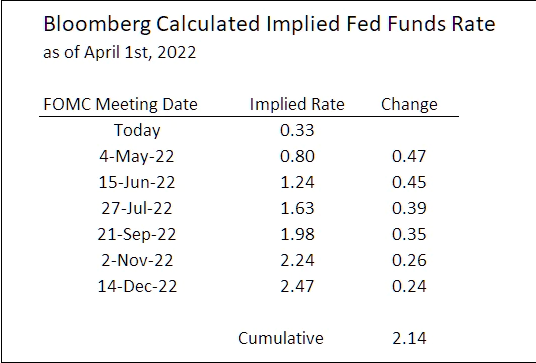

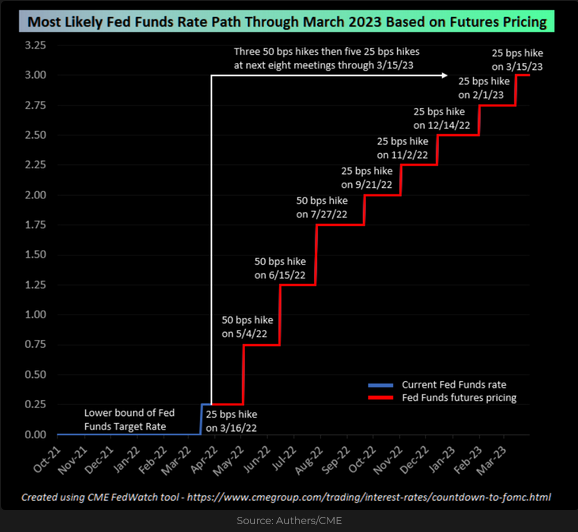

After much hesitation, the Fed is signalling that it will raise interest rates aggressively over the next several months. Here’s what the market expects from the Fed (h/t to The Macrotourist):

The Chicago Mercantile Exchange futures market pricing of Fed funds through March 2023:

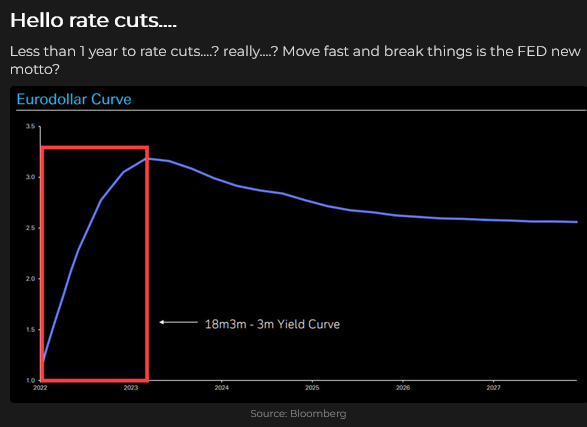

After the sharp rise over the next 12 months, the market is pricing short-term interest rates to drift lower (tightening into a recession?)

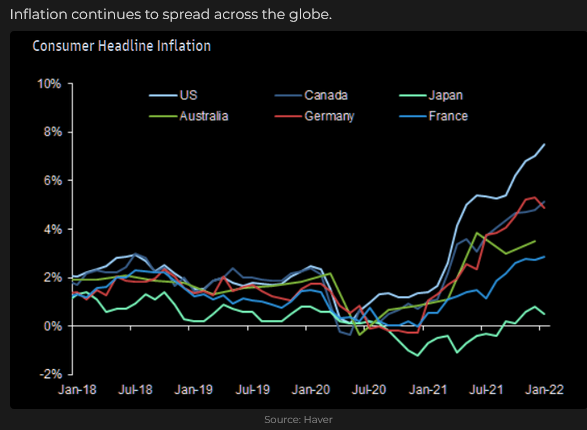

Last year, in the face of sharply rising inflation, the Fed not only kept interest rates low but sustained their Quantitative Easing (QE) policies, buying hundreds of billions of dollars worth of bonds and mortgages. Their justification was that inflationary pressures were “transitory” and that “on average” inflation would be around 2%.

The market saw things differently and began to price in persistent and rising inflationary pressures. The market viewed the Fed as being “behind the curve;” the Fed was following, not leading the market.

This chart of the Treasury 2-year Note gives some perspective on how dramatically the market moved (before the Fed) since last fall. (Falling prices mean yields are rising.)

Some analysts expect the Fed’s tightening (their attempt to “cool” inflation) will cause the economy to contract (a highly indebted economy can’t handle rising interest rates), and they will be guilty of tightening into a recession.

Other analysts see continuing high inflation, despite rising interest rates as governments increasingly embrace fiscal deficits. They believe that real interest rates will remain negative, and the market will demand “inflation hedges.”

From a consumer (voter) perspective, inflation creates a lower standard of living as their money has less purchasing power. Governments, seeking votes, may attempt to ameliorate this perception of a lower standard of living. For instance, they may cut some taxes, run large budget deficits, release crude oil from the strategic reserve, and suggest that to ensure the security of domestic supply, people will need to “shoulder” higher prices for “the common good.” (Do you remember President Jimmy Carter telling people to turn down the thermostat and put on a sweater when fuel prices soared?)

It seems highly likely that after twenty or thirty years of relatively benign inflation, we are “transitioning” into an era of higher inflation and supply shortages.

Real estate charts

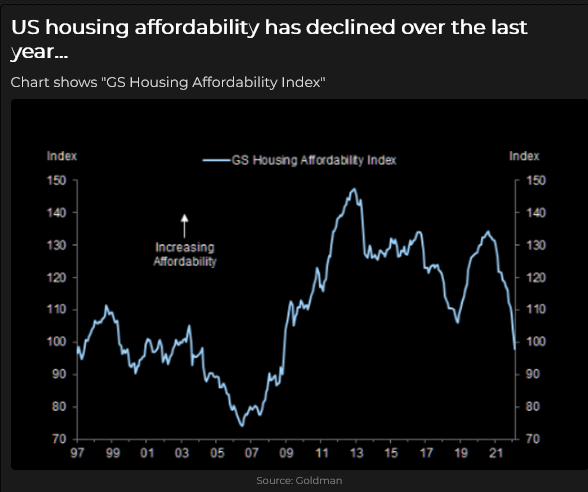

USA home prices:

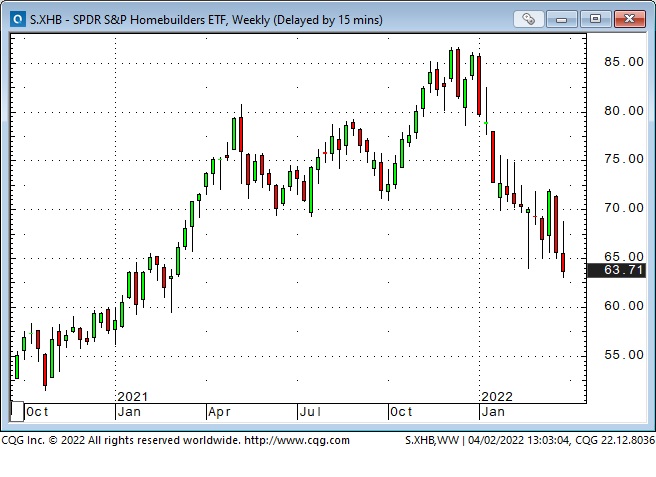

Soaring home prices and mortgage rates may produce “demand destruction” for new and existing homes. This chart of the Homebuilder’s ETF is at >12-month lows.

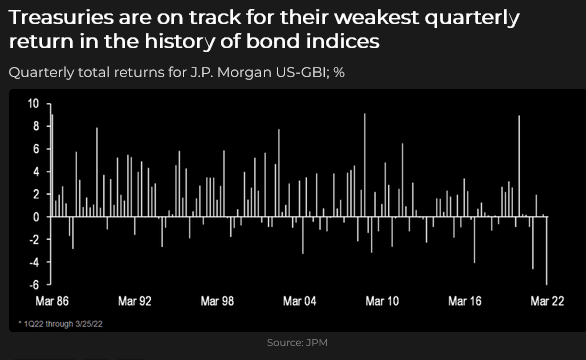

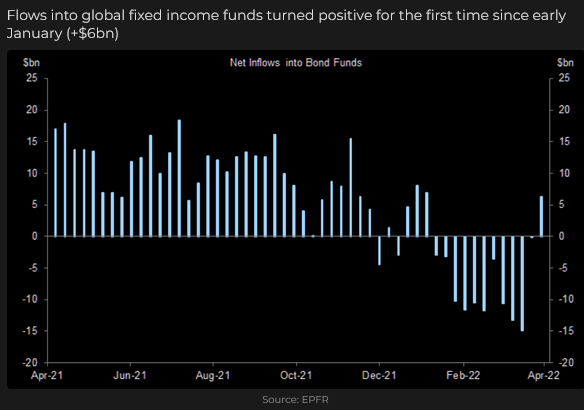

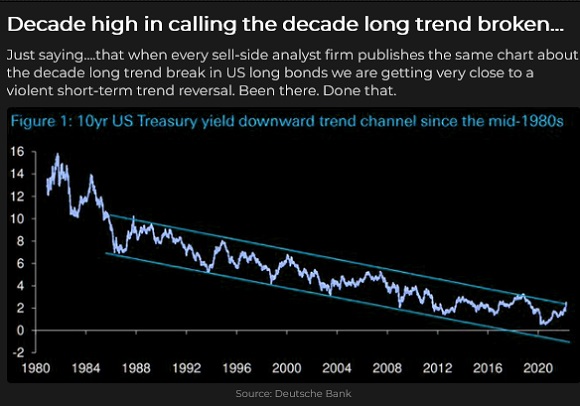

The bond market: was Q1/22 the worst quarter ever?

Different analysts have described Q1/22 as the “worst ever” for the bond market. When I look at multi-decade charts of the long bond, I can’t entirely agree with that conclusion, but if I look at shorter-term bond charts (two to five-year maturity), I can agree.

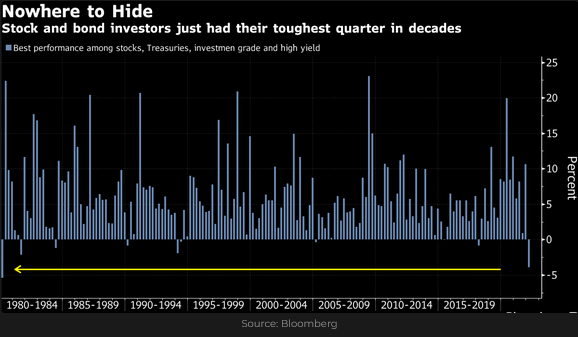

I’ve seen other reports claiming that the classic 60/40 stock/bond portfolio had its worst quarterly performance in >40 years as stock and bond prices fell in Q1/22.

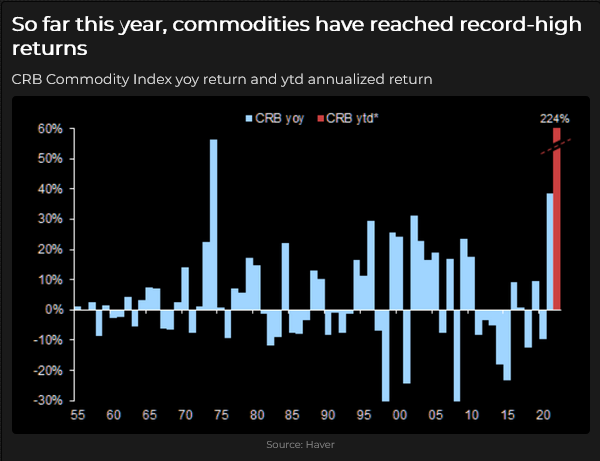

The commodity market: Q1/22 was the best ever!

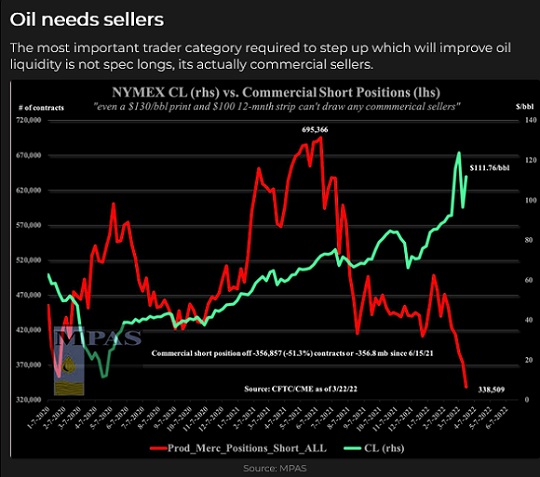

The leading commodity indices have been trending higher since the 20+ year low made in early 2020. The indices spiked dramatically higher in Q1/22 as the Russian invasion of Ukraine ignited supply concerns for food, energy, base metals and other commodities.

The ultimate “pain trade”: buy bonds / short commodities!

On the theory that market momentum takes markets too far in one direction and that “reversion to the mean” causes the price/sentiment “pendulum” to reverse course, is there an opportunity/reason to look at buying bonds and selling commodities – as an outright trade or as a “recession” hedge? Could a Fed “policy error” induce a “growth shock?“

Commodities have had a spectacular run with a possible blow-off top in March, and they have rolled over from a lower high. The bullish commodity “narrative” remains strong, and prices may well be much higher in the future, but if the indices drop through the March lows, they could fall further.

Bonds have been in the doghouse, and the “whole world” is short bonds. Maybe the “inflation is going to be much higher for much longer” narrative is fully priced in. (See the Quotes section below for a discussion of “fully priced in.”)

A vicious circle: wild price action and shrinking liquidity

Wild price swings across equities, interest rates, commodities and some currencies in Q1/22 led to significantly reduced liquidity as traders backed away from risk as margin requirements skyrocketed. Volatility soared. Falling liquidity accelerated short-term price swings and meant that option positioning and capital flows had an outsized impact on prices.

Open interest in several futures markets fell to multi-year lows as wild price action and increased margin requirements caused traders to back away. For instance, open interest in the leading S+P 500 futures contract dropped to a 14 year low. Open interest in fossil fuel contracts, wheat and soy oil contracts, and silver and copper contracts fell to multi-year lows.

My short term trading

I caught the first few days of the stock market rally off the mid-March lows – but took profits too soon. Last week, I started shorting the rally (with small positions and tight stops) and lost a little money. I thought that the rally was a bear market rally and would rollover. This week, I continued with that idea, lost a little money early but benefitted from the 100+ point decline late in the week. I stayed short a small S+P position (with stops that will lock in a profit if the market rallies) into the weekend.

The Wednesday to Friday decline may have been only a brief correction to the rally that began mid-month, but if prices break decisively below 4500, that will harden my views that this has been a bear market rally.

I’ve been shorting the CAD around 80 cents, thinking that the spectacular YTD commodity rally could fade. I’ve lost a little money shorting the CAD but remain short into the weekend.

My P+L on realized trades is down ~0.75% this week, while unrealized gains total ~0.60%.

Transports flash a warning: Only one stock in the 20-stock Transports Index closed higher on Friday, and it was only up a fraction of 1%. The index closed Friday down ~7.3% below the 4-month highs made Wednesday.

Thoughts on trading

My primary trading objective is to protect my capital. My experience tells me that I will have winning trades and losing trades, so it’s important to keep losses small to be “alive and willing” to make future trades that might be winners. Staying alive and willing to trade is critical!!

I measure my risk tolerance in absolute dollars, not as a percentage of the item I’m trading. As a result, the huge price swings in many markets over the past few months drew me into shorter and shorter time frames and smaller-sized trades. For instance, it has not been unusual for the S+P (and many other markets) to move as much in an hour as it previously moved in a day.

Intraday trading seems to be more subject to chart patterns and random “noise” than swing trading. (Or it could be that all time frames have been subject to the recent poor liquidity, “headline” risk and choppy price action.)

I’ve long maintained that traders need to find a way to trade that “suits” them. My “sweet spot” seems to be a swing trading time frame of a few days to a few weeks, and that time frame appears to assign value to assessing market fundamentals, shifting sentiment and price action.

For most of my trading career, if I closed out a trade the same day I put it on, it was almost always a losing trade – I rarely initiated a trade to book a profit from it the same day. I’ve done some day-trading the past couple of months, and I’ve made some money doing that, but it required me to be constantly in front of my screens, and it is a different way of trading. I prefer the swing trading time frame over the day-trading time frame.

Years ago, I wondered if the path to making more money from trading would require me to increase my size substantially or to stay with my winning trades much longer. Or both! I decided to try staying with winning trades longer. In terms of the Rabbit or the Tortoise, I seem to be a Tortoise! I hate big losses – so I’m not willing to risk big losses to make big gains!

Quote of the week

“Sometimes the most difficult part of investing is not figuring out what will occur, but what’s already priced in!” Kevin Muir, the Macrotourist, April 1, 2022.

My comment: I read this quote in Kevin’s blog yesterday and laughed out loud! This is the trader’s perennial conundrum – “Is my trade idea already fully expressed in the market? If it is, I’m buying the high; if it isn’t, I can make money if I buy it here, and the market goes higher.”

Dennis Gartman used to say that a trader’s job was to buy high and sell higher – that is, buy markets that are going up and sell them after they have gone up some more. (Sell markets that are going down and take profits after they have gone down further.) In other words, trade in line with the trend.

The Barney report

Barney is nearly seven months old and weighs 52 pounds. Most days, we do a one to two-hour morning walk and a half-hour afternoon walk, and he sleeps when we come home. This week, we got out for his first-ever after-dinner walk, and Barney saw his first rabbit. Thankfully, he was on a leash at the time!

A Request

If you like reading the Trading Desk Notes, please forward a copy or a link to a friend. Also, I genuinely welcome your comments, and please let me know if you would like to see something new in the TD Notes.

Listen to Victor talk about markets

I’ve had a regular weekly spot on Mike Campbell’s extremely popular Moneytalks show for 20 years. The April 2nd podcast is available at: https://mikesmoneytalks.ca.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything.

- Russia is on track to make $321 billion from energy exports in 2022 if trading partners keep buying its oil and gas, according to a Bloomberg analysis Friday.

- An energy embargo by the EU, the UK, and the US could cost Russia as much as $300 billion in export receipts.

- The US and the UK are among a few nations that have outright banned Russian imports.

Russia looks on course to bring in more than $300 billion in energy revenue in 2022 if its major trading partners keep buying its oil and gas, according to a Bloomberg analysis published Friday.

An estimated $321 billion in energy exports would be an increase of more than a third from 2021 as Russia deals with economic pressure in the form of sanctions from Western nations for launching a war against Ukraine in late February.

Many of Russia’s energy customers are looking to purchase supplies from other areas and are not signing new contracts. A widespread embargo on energy sales would sharply cut into Russia’s sales but, for now, the US and the UK are among a few nations that have outright banned Russian imports.

“The single biggest driver of Russia’s current account surplus continues to look solid,” Bloomberg quoted economists at the Institute of International Finance, or IFF, as saying in a report. “With current sanctions in place, substantial inflows of hard currency into Russia look set to continue.”…read more.

A Vancouver strata owner who charged his electric vehicle (EV) using a parking stall outlet won’t be allowed to do that anymore.

That’s the decision from B.C.’s Civil Resolution Tribunal, which said March 24 that Ian Wong saw power turned off to the outlet by his strata corporation.

He asked the tribunal to decide that the power should be turned back on in exchange for a ‘reasonable fee.’

The strata, however, denied Wong is entitled to use its common electricity to charge his vehicle.

The tribunal agreed there was no requirement to let Wong use common property.

The strata said it has now passed a rule prohibiting EV charging through any 110-volt common property outlet…read more.

B.C.’s human rights commissioner has written Dr. Bonnie Henry, suggesting it was too soon to lift the province’s mask mandate.

“Lifting the mask mandate will do disproportionate harm to those who are already marginalized, forcing many to withdraw from activities of daily life in an effort to protect their health, and reducing the capacity to enjoy their human rights to their full extent,” wrote Kasari Govender.

Henry ended the public health order requiring masks on March 11.

Govender is urging the Public Health Officer to ensure that all actions respect the human rights of all people, including those who are more vulnerable to COVID-19, such are Indigenous, racialized people, older people and those with disabilities, including those who are immunocompromised.

“It is understandable that after two years of the global pandemic, many people are tired of wearing masks. But the requirement to wear a mask in indoor public spaces is a comparatively minor infringement on an individual’s autonomy and an inconvenience in exercising one’s rights…read more.