Stocks & Equities

It’s hard to be bearish in December.

This is the time of good cheer, dancing sugar plums, and brandy-spiked eggnog. It’s also the time of rising stock markets.

More so than any other month of the year, December has a bullish bias. Going back to 1950, stocks showed gains in December 47 out of 63 years. That’s 74% of the time. If we only go back to 1970, the bulls are 35 for 43 – an 81% win rate.

So like I said, it’s tough to be bearish during this time of year. But it’s also tough to overlook this…

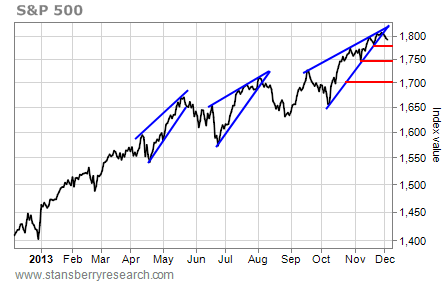

The daily chart of the S&P 500 below shows the index breaking down from a bearish rising-wedge pattern.

Previous breakdowns in May and August led to modest 6% and 4.4% pullbacks, respectively, over the following month. Something similar this time around would set a target for the index somewhere between 1,740 and 1,700.

Yesterday, the S&P 500 tested its first red support line at about 1,780. After falling for four straight days, stocks are oversold enough that they could bounce from this level over the short term.

However, any bounce that fails to rally the S&P 500 to a new all-time high above 1,813 will form a “lower high” on the chart. That’s a reversal pattern, and it increases the chances the next decline will take out support at 1,780 and spark a move toward one of the lower support lines.

So go ahead and be cheery. Be merry and full of goodwill. And be bullish if you like. But be careful, too. Given the look of this chart, stocks have more downside.

Best regards and good trading,

Jeff Clark

Further Reading:

Earlier this week, Jeff revealed another reason for caution: One specific thing happened within months of every single market peak of the last 41 years. And it might be happening again right now. Get all the details here.

One of the stock market’s most reliable indicators is also pointing to a reversal. “We now have a broad stock market sell signal,” Jeff writes. “And the first sign that at least a short-term top may be in place.” See the chart right here.

I had the chance recently to reconnect with John Rubino, CFA Institute contributor, blog publisher, and author of a number of financial books.

I had the chance recently to reconnect with John Rubino, CFA Institute contributor, blog publisher, and author of a number of financial books.

It was a particularly interesting conversation, as John has written a number of prophetic books warning of growing asset bubbles, and currently produces editorial research for CFA designated fund managers worldwide. As the subject of discussion, was a recent piece published by John, entitled,“Inflation is Raging – If You Know Where to Look“.

In discussing his research on global markets, John notes that frightening asset bubbles are developing all over the world, and as a case in point, “Bitcoin…was about a dollar per Bitcoin a couple of years ago. Now it’s $1000…A painting by Francis Bacon called ‘Three Studies of Lucian Freud’ [just] sold for $142 million, which was the highest price ever paid for a painting at an auction….[A] diamond [just] sold for $83 million which is the highest price ever paid at auction for a diamond, and trophy real estate in Manhattan, London, Singapore and Hong Kong have all blown through previous records…So there are asset bubbles [occurring] all over the world.”

There is one final hard asset group which has yet to move into euphoric pricing John noted, and, “If you drew up a chart of all the hard asset investment options for the average member of the 1%…they would look at that chart and say, ‘OK, well my penthouse has doubled. My paintings are way up. My jewelry is way up. Well, look at gold and silver. It’s actually down. Let’s move some money in that direction.That’s the last good deal that’s out there on the list of things that are not fiat currency.’”

The fact that precious metals have yet to move into a bubble-phase according to John, “Implies that gold and silver are being really aggressively manipulated at this point and the reasoning for that makes complete sense—the central banks of the world need to depress gold and silver because those are forms of money which compete with the dollar and the euro in the end. When they go up, they make those currencies look bad.”

As a consequence of the ‘monetary truth-telling’ aspect of gold, “The central banks of the world…as part of the process of greatly expanding government debt, and financing that debt with newly created currency…have to use some of that currency to push down the value of gold and silver and they’re doing it,” John added, “So at some point in the not too distant future, this game has to end and when it does…the market [will] decide where gold and silver should be…[and] they will just snap right back into [price] alignment with art and jewels and high end real estate…or we’ll see a [supply] default on one of the major metals exchanges…”

As a final comment to investors, John noted that if confidence, “[Is] shaken in one major currency, it will be shaken in all of them…Once [the people] figure it out the game is over…[and we’ll] have to go back to some form of sound money. That’s really the end result of all of this—is that we will go back to gold and silver…something that cannot be inflated away [and] cannot be created in infinite quantities by central banks.”

—

This was a powerful interview, conducted with an author and researcher who’s work is mainly reserved exclusively for asset managers worldwide. It is required listening for serious investors and market students.

To listen to the interview, left click the following link and/or right click and “save target as” or “save link as” to your desktop:

>>Interview with John Rubino (MP3)

To learn more about John Rubino and to follow his regular work visit:DollarCollapse.com

Enjoy the interview? Please support the site by sharing this URL page link with friends, family, and your favorite chat forum.

Thanks,

Tekoa Da Silva

Bull Market Thinking

Hackers have stolen usernames and passwords for nearly two million accounts at Facebook, Google, Twitter, Yahoo and others, according to a report released this week.

The massive data breach was a result of keylogging software maliciously installed on an untold number of computers around the world, researchers at cybersecurity firmTrustwave said. The virus was capturing log-in credentials for key websites over the past month and sending those usernames and passwords to a server controlled by the hackers.

….more HERE

On the other side of the world today, a couple of gentlemen that few people have ever heard of signed an agreement that has massive consequences for the global financial system.

On the other side of the world today, a couple of gentlemen that few people have ever heard of signed an agreement that has massive consequences for the global financial system.

It was a Memorandum of Understanding signed by representatives of the Singapore Exchange and Hong Kong Exchange. Their aim– to combine their forces in rolling out more financial products denominated in Chinese renminbi.

This is huge.

Hong Kong and Singapore are THE two dominant financial centers in Asia. For years they’ve been locked in competition with one another, much like New York and London. So their public partnership is a very big deal… indicative of the clear objective they have in front of them.

Bottom line– finance executives in Asia see the writing on the wall. They can see that the dollar is in a period of terminal decline, and it’s clear that the Chinese renminbi is going to take tremendous market share away from the dollar. They want a big piece of the action.

The renminbi has already surpassed the euro to become the #2 most-used currency in the world when it comes to trade settlement, according to a report released yesterday by the Society of Worldwide Interbank Financial Telecommunication (SWIFT).

Right now the renminbi has about an 8.6% share of the global market for trade settlement. Granted, the dollar has the lion’s share of trade settlement at more than 80%.

But just look at how quickly the renminbi has grown; in January 2012, its share of the global market was just 1.9%. So it’s grown by nearly a factor of 5x in less than two years.

With today’s agreement between Hong Kong’s and Singapore’s financial exchanges, that growth will likely accelerate.

As we’ve discussed before, the dollar is in a unique position simply because it is the world’s dominant reserve currency.

This means that when a rice distributor in Vietnam does business with a Brazilian merchant, they’ll close the deal by trading US dollars with each other… even though neither nation actually uses the dollar.

It’s been this way since World War II, simply because there has been such a long tradition of trust in the United States, and a steady supply of dollars throughout the world.

But this confidence is fading rapidly as merchants and banks around the world have been seeking alternatives, primarily the Chinese renminbi.

As the dollar’s market share in international trade decreases, it will mean the end of US financial privilege. No longer will the US be able to print money without repercussions.

And as so many other nations have learned the hard way, when you print money with wanton abandon and indebt your nation to the hilt, there are severe consequences to pay.

Today’s move between Hong Kong and Singapore gives us a glimpse into this future.

We’ll soon see more financial products– oil, gold, Fortune 500 corporate bonds, etc. denominated in renminbi and traded in Asia.

And as trade in these renminbi products grows, the dollar will be closer and closer to its reckoning day.

Years from now when this has played out, it’s going to seem so obvious.

Just like the post-Lehman crash in 2008, people will scratch their heads and wonder– ‘why didn’t I see that coming? Why didn’t I recognize that it was a bad idea to loan millions of dollars to unemployed / dead people?’

Duh. Same thing. People will look back in the future and wonder why they didn’t see the dollar collapse coming… why they didn’t recognize that it was a bad idea for the greatest debtor nation in the history of the world to simultaneously control the global reserve currency…

The warning signs are all in front of us. And today’s agreement between Hong Kong and Singapore is one of the strongest signs yet.