Gold & Precious Metals

It’s time to officially bury Goldbug Macro

Posted by Joe Weisenthal - Bloomberg

on Monday, 5 April 2021 8:59

You know, the school of thought that’s always warning about dollar debasement and inflation as a result of money printing.

Here is a chart of gold over the last 10 years. It’s up about 10%. During this period we’ve run large deficits the entire time, and in fact over the last year, some of the biggest fiscal stimulus of all time. During this time the size of the Fed’s balance sheet rose to nearly $8 trillion from under $3 trillion. Not only has gold performed poorly, the dollar is still dominant.

Not only that, inflation has been mild, contra to what all the Goldbug Macro types would have predicted. Of course, they would probably come back and say that inflation is actually being mis-measured and that it’s way higher if only you look at it the right way. Or that it’s showing up in asset values or something like that. Even if you were to grant all that as true, gold hasn’t benefited, so their case hasn’t been helped much. As we saw in the wake of the Great Financial Crisis and over last summer, gold seems to do well during periods of stagnation plus aggressive Fed easing. But that’s about it. After two huge crises in just over a decade, plus fiscal and monetary stimulus the likes of which we haven’t seen before, we now have enough evidence to bury the economic fantasies of gold’s most ardent believers.

Gold Production Expected to Rise in 2021

Posted by MoneyTalks Editor

on Friday, 12 March 2021 10:27

In their recent Industry report Raymond James analysts Farooq Hamed and Judith Elliot expect significant rebounds for precious metal producers in 2021.

According to Mr. Hamed, “in general, precious and base metals producers continued to generate positive [free cash flow] in the fourth quarter of 2020, however at lower levels than in the previous quarter due to lower quarterly average gold prices. We expect increasing production over the next three years.”

In most cases, this involves a return to ‘normal’ operations after 2020 was marked by downtime caused by Covid-related shutdowns. Among precious metal producers the report expects strong production gains from are firms like Agnico Eagle, Yamana Gold and Calibre Mining.

Interesting to note that Raymond James has Calibre (TSX:CXB) as a “strong buy”, and BMO Nesbitt Burns has also started Calibre Mining coverage with a “market perform” rating. You can watch Ryan King’s complete Calibre Mining presentation from the 2021 World Outlook Financial Conference, along with 15 other precious metals companies HERE.

Elsewhere Mr Hamed and Ms. Elliott see exploration spending ticking up across the sector. With improved balance sheets and a focus on replacing reserves, producers are providing forward looking guidance of significant increases in 2021 exploration budgets.

At the same time operating costs are generally expected to be higher year over year as companies factor in additional health and safety costs related to Covid protocols and higher inputs on cost inflation.

Silver or Red Hot Chilli Peppers?

Posted by Tyler Durden

on Tuesday, 2 February 2021 7:13

So John (and Jack2343 and Jane1928273) went long, and silver went up, and physical silver split from paper – because if you are going to nail yourself to a cross of precious metal then do it properly, right?

At least it made a change from the social media meme of Fry from Futurama holding out (paper) money and saying: “Shut up and tell me which stocks to buy to punish rich people.” And did we achieve a global reflation as a result?

Ironically, Bloomberg crows that, yes, reflation trades are indeed back on, with the US Treasuries 5s-30s spread widening out to 143bp on Monday, the widest since 2016. All I can say is that those buying that particular market trend are like Fry from Futurama holding out (newly printed central-bank paper) money and saying: “Shut up and tell me which commodities to buy to punish poor people.”

What we see all round us is global billionaire after billionaire getting more billionaire-y, and their pet projects to match: overnight Hollywood genius, galactic explorer – how long until one decides to turn the moon into cheese? Hedge funds would buy it; and if it were shorted by them then Redditors would, so cheesy moons are surely a win-win. Or how about just wiring up a monkey brain to play video games? But rather than gargling such central-bank bong water, let’s recall markets are allegedly trading for The Great Reflation, and not The Great Gatsby, because we are going to see joined up fiscal and monetary policy.

Now this would be a real game-changer. Really. Except it isn’t happening.

The Resurgence of Silver

Posted by James Rickards

on Friday, 29 January 2021 10:56

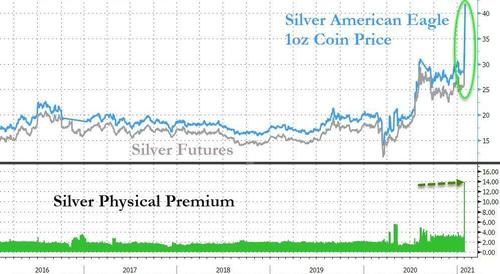

Most investors who focus on precious metals and commodities know that gold had a great year in 2020, up 24.6%. However, not as many know that silver did even better! Silver was up 47.4% in 2020, rising from $17.80 per ounce on January 2, 2020, to $26.35 per ounce on December 31, 2020.

Silver didn’t just outperform gold in 2020; it also outperformed every other major asset class, including U.S. small cap stocks (up 18.5%), U.S. stocks (up 15.5%), U.S. corporate bonds (up 9.7%) and U.S. Treasuries (up 3.6%). Many other asset classes declined in price in 2020, including commodities, the U.S. dollar, real estate and crude oil.

Silver backed off a little in early 2021 (it’s now trading around $25.25 per ounce), but it has held onto almost all of its 2020 gains. Of course, the question for investors is: Where do we go from here?

Mining supercycle talk back as copper, iron ore prices surge to 7-year highs

Posted by mining.com

on Wednesday, 2 December 2020 9:08

The copper price was trading at its highest since March 2013 on Tuesday after Chinese data showed manufacturing and construction in the world’s second-largest economy was expanding at a pace not seen in a decade.

On the Comex market, copper for delivery in March jumped 2.4% to $3.5215 a pound ($7,764 a tonne) in New York, racking up its fifth straight day of gains. The copper price has advanced 26% year to date after recovering from a dip below $2.00 a pound at the height of the pandemic in March.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $132.13 a tonne on Tuesday. That was the highest level for the steelmaking raw material since January 2014 and brings gains for 2020 to over 43%. CLICK for complete article

-

I know Mike is a very solid investor and respect his opinions very much. So if he says pay attention to this or that - I will.

~ Dale G.

-

I've started managing my own investments so view Michael's site as a one-stop shop from which to get information and perspectives.

~ Dave E.

-

Michael offers easy reading, honest, common sense information that anyone can use in a practical manner.

~ der_al.

-

A sane voice in a scrambled investment world.

~ Ed R.

Inside Edge Pro Contributors

Greg Weldon

Josef Schachter

Tyler Bollhorn

Ryan Irvine

Paul Beattie

Martin Straith

Patrick Ceresna

Mark Leibovit

James Thorne

Victor Adair