Click on image for Larger view Acquire gold, accumulate silver:

Gold is an expensive commodity and the most demanded precious metal. The measure of risk in Gold is bare minimum in longer run and is almost negligible in shorter run as investment compared to other investment tools such as currency & stocks. Even compared to other consumable precious metals, gold has stood its worth for centuries and persevered the tides of time. Many experts convert their fixed assets or long term investments in gold so that they can hedge timely against the inflation.

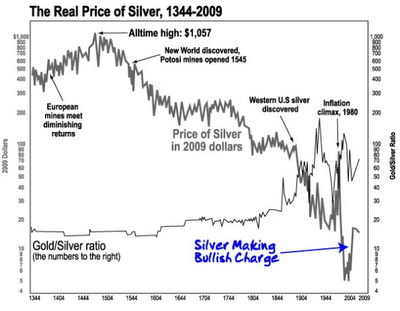

Silver on the contrary has a lesser price bracket but there is tremendous potential present in silver due to its widespread demand. People want to now accumulate silver for various reasons. One particularly is due to the fact that citing reference to the worst economic/hyperinflation scenario in Zimbabwe people have taken notes for a situation where the currency will lose all it purchasing power and then silver will be used as trading commodity for every day consumption. In this event the demand of silver is on an upward consistent curve and supply is speculated to drop due to its high demand in hi-tech IT & electronic industry. Thus silver is considered to carry more potential thus for price shoot.

Click on image above for Larger view

History of Gold & Silver:

Experts call Gold & Silver real money; which itself is based on their long history of serving as currency & a mode of exchange. Since ancient times these two precious metals have been treated as something related to value or worth, whether it is religious purity or jewelry for the purpose of fashion & beautifying, these precious metals were always meant for valuables.

It could be their shine, color or shape that attracted human beings towards it but it was the people in the regions of Transylvanian Alps or in the territory of Mount Pangaion in Thrace who started mining it to use them for decorative purpose that exhibited their prosperity. Till today the financially educated and elites use it to ensure their continuous well-being.

The greatest opportunity in history – Gold Silver Mania:

The recent economic recession has raised concerns for many who thought that they fell prey to unsupervised economic plans and yet there were others who were shielded against it through precious metal buying which always indicated and preached about long-term profits.

Triggered by the success of the precious metal owners; now there is gold & silver buying mania everywhere; as they see these times as the greatest opportunity ever to rebuild on the mistakes of US & western fiscal policies. This way people were not only able to guard themselves but they were also able to capitalize on the profits created by the real intrinsic worth of precious metals.

Now people are converting and securing all their cash and liquid assets into precious metals by buying precious metals such as silver and gold, and there is a world-wide awareness campaign through which people are preparing themselves for future profits while covering up past losses.

Silver will play as the major currency worldwide due to its low price (as compared to Gold), easily exchangeable feature and ability to purchase everyday consumables. It’s demand is going to be much more vast as compared to gold, particularly in developing economies silver is going to be replace gold and will be main mode of exchange even on the higher level. Gold will be fundamentally used as saving instrument which will be cashed (for a smaller currency bill) to silver in order to make it viable/convertible for every day buying. Therefore the excruciating demand and limited availability and supply of silver are going to drive its value manifolds and its price will show dramatic movement in the times to come.

This article provided by Dr. Atif Khan, Ph.D of Sunshine Profits

We are investors, who take this profession very seriously. We spend a LOT of time doing various researches, finding correlations and investigating historical patterns, so that you don’t have to. Przemyslaw Radomski, Sunshine Profits’ main editor, founded this Website, as he felt that although there are numerous valuable services on the Internet, investors, could use some additional guidance, especially when it comes to timing these volatile markets.

Here, at Sunshine Profits we believe that we are in a secular bull market in all commodities and that precious metals will be among its greatest beneficiaries. Once established long term trends, our investment strategy focuses on evaluating low-risk entry points, as well as timing potential tops.

…..read more HERE