Silver Investing – Rule #3

Boost the buying power of your dollars with silver mining shares.

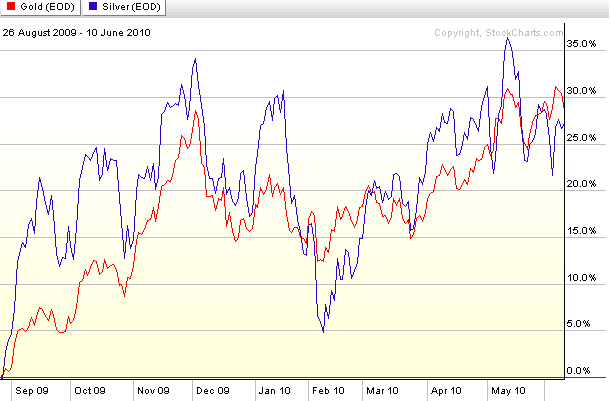

If you are a typical investor, you cannot expect to be an expert on silver and the silver market- but you can invest in the people who are. Once you have established a core holding of physical silver, leverage both your knowledge and your buying power by purchasing the stocks of mining companies. These shares are highly responsive to changes in silver prices, frequently producing much higher percentage returns than the metal itself.

This rule is one that many silver investors know quite well and the joys of watching your mining stock outperform the increase in bullion prices by a factor of two or three to one is exciting. However, leverage works in both directions and when the price of the precious metals fall back the mining shares fall back hard. This is normal market behavior and should be anticipated by the savvy metals investor.

Silver Investing – Rule #2 – Start small- keep it simple.

Too many investors, upon deciding to beef up the metals portion of their portfolio, buy too much physical silver at once-and in the wrong forms. Beginning metals investors should concentrate on pure bullion bars or coins, in smaller sizes, looking to pay a minimum premium over the actual metal value. Avoid commemorative coins, decorative items, jewelry and other collectibles, all of which carry large premiums and have limited resale markets.

Anyone that has spent much time on our website www.silver-investor.com knows we have consistently advocated that all metals investors begin with a physical position before making any other type of precious metals investment. Certainly, mining stocks offer leverage and can at times multiply your wealth substantially it is only by starting with the sure thing, real metal that you build a foundation of wealth.

Silver Investing – Rule #1

The following is a recent interview l did with Ellis Martin on the first rule of silver investing. As you will read, we got off topic but did cover a great deal of current concerns of investors.

David Morgan: I was asked to write the ten rules of silver investing for a book titled, Investing Rules. Rule Number One states, “When all else fails, there’s silver.” No one likes to be a prophet of doom, but the simple truth is that silver is the world’s money of last resort. Should a severe economic collapse occur, leaving paper assets worthless, silver would be the primary currency for purchases of goods and services (gold will be a store of major wealth but would be priced too high for day-to-day use). Thus every investor should own some physical silver and store a portion of it where it’s accessible in an emergency.

I wrote that, and it’s as valid today as it was when I wrote it. I haven’t reviewed these in a very long time. If I had to assert one rule of silver investing it would be to buy physical silver. The truth of the matter is, in the absolute worst-case conditions you would want some silver. As I just said, the reason silver is important in a currency crisis is that you’re not going to buy gas with a one- or half-ounce gold coin—it’s going to have too much value.

Silver has been money more often, for longer periods of time, in more places in the world than gold has. And that is because it’s the merchant-class metal, because most of the time in your daily transactions, what are you buying? You’re not buying your car or your house; the car is perhaps a purchase you make every five years, the house sometimes once in a generation. But it’s the silver that passes hands on a daily basis.

Certainly I am a gold advocate. Indeed, as I say in this Number One rule, it’s a way to preserve large amounts of wealth in a very small space and that’s great and all investors should recognize that fact. But if you’re really thinking outside the envelope, silver is absolutely the place you should be for part of your money.

Mr. Martin: We’re not just talking about obtaining physical silver for investment purposes. You’re saying it is also the best metal currency to use in the case of complete economic collapse, in order to obtain either a loaf of bread or a gallon of gas?

Mr. Morgan: Right; it’s more liquid. It’s simple because, you know, $0.25 in today’s money is worth about 14 times. It’s worth $2.50, $3.00, maybe three and a half bucks. So a quarter in silver would probably buy you a couple of loaves of bread or a gallon of gas now in today’s economy. But I want to emphasize, too, that this is absolutely the worst-case scenario. Do I see the worst-case scenario taking place? I don’t think so.

But that doesn’t mean you shouldn’t buy silver. I mean there are lots of other reasons to buy silver. If you go the other extreme—the best-case scenario—the world gets turned around and we start having prosperity everywhere and it’s the best global economy that’s ever happened in the history of mankind. Okay, so let’s take that extreme. In that case, silver would still make an absolutely excellent investment. Most likely far superior to gold from the aspect that there would be such a boom in industry and such a boom in commerce that there would be so much more silver used by the average person because everyone would have an iPod or two, a flat-screen TV, a couple of computers, another car or a washing machine, more electronic devices. So there would be this huge boom to the silver market. Thus, silver is as much a good-time investment as it is during uncertain economic times.

Mr. Martin: Let’s talk about your Web site, www.silver-investor.com.

Mr. Morgan: I actually started it as a Web page and built the initial site myself. I don’t have the ability or don’t have the time to do that now. It was a research site I established for myself when I was doing some consulting and trading. After a couple of years I renamed it silver-investor.com. One thing led to the next—it started getting traffic and it grew into a commercial site.

There are really two newsletters if you want to call them that. One is a free newsletter you can receive by e-mail just by signing up for free on the Web site. This free newsletter provides updates on silver, where I’m speaking, and my answer to a question of the week. This is useful because many people ask me questions on the market, and part of my mission is to educate people. I try to pick one and answer that for everyone.

Then there’s The Morgan Report, which is for your serious, sophisticated investor. It really isn’t a newsletter for someone who is a beginning investor. I’m sure I’ve got a few beginners, but most members are extremely intelligent and very knowledgeable and experienced in the investment arena, and those are the type of people who pay for this type of work.

I’m always trying to bring more value to people, both for the free site and members portion. Charles Savoie has done great research for us. He’s in the archive section of the Web site. It’s a very in-depth site, as you know, and ranked well in the Google search engine.

Mr. Morgan has followed the silver market for more than thirty years. He wrote the book, Get the Skinny on Silver Investing. Much of his Web site, Silver-Investor.com, is devoted to education about the precious metals, it is both a free site and does have a members only section. To receive full access to The Morgan Report click the hyperlink.

Subscribe To The Silver Investor Today

Disclaimer: Information contained herein has been obtained from sources believed to be reliable, but there is no guarantee as to completeness or accuracy. Because individual investment objectives vary, this Summary should not be construed as advice to meet the particular needs of the reader. Any opinions expressed herein are statements of our judgment as of this date and are subject to change without notice. Any action taken as a result of reading this independent market research is solely the responsibility of the reader. Stone Investment Group is not and does not profess to be a professional investment advisor, and strongly encourages all readers to consult with their own personal financial advisors, attorneys, and accountants before making any investment decision. Stone Investment Group and/or independent consultants or members of their families may have a position in the securities mentioned. Investing and speculation are inherently risky and should not be undertaken without professional advice. By your act of reading this independent market research letter, you fully and explicitly agree that Stone Investment Group will not be held liable or responsible for any decisions you make regarding any information discussed herein.