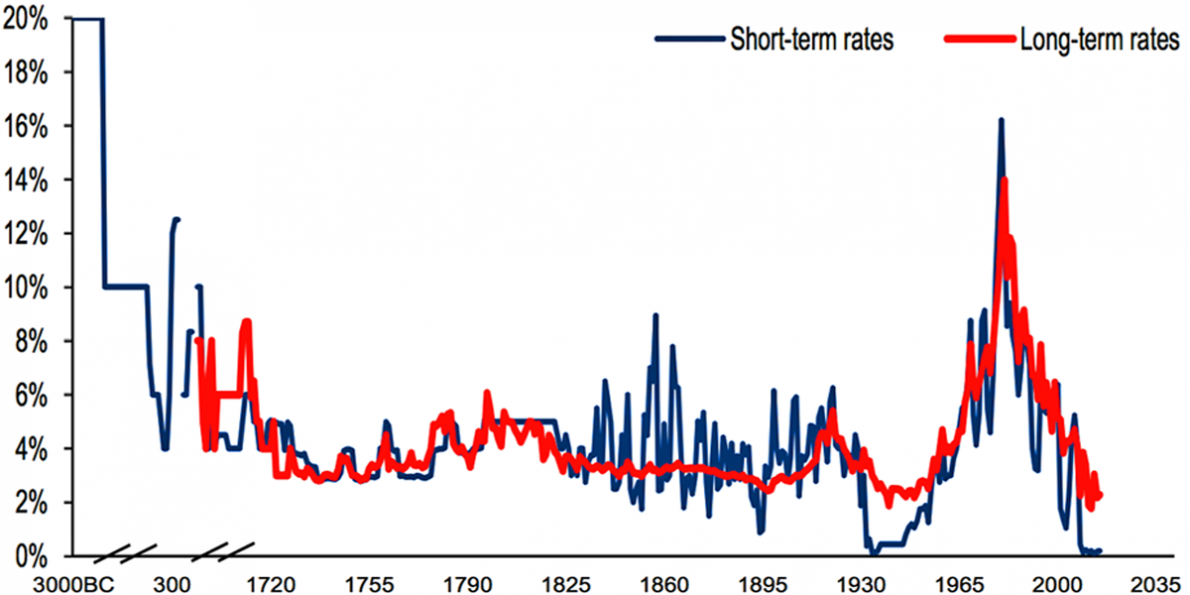

The evidence continues to mount that the 35 year bear market in US bonds is over, interest rates are heading up and the implications are dramatic. For example, the rate on a 10 year US bond is 2.37%. Compare that to the rate of a 10 year German bond of .35% and you know why German money is flooding into the US driving the dollar higher and other currencies down. (full transcript below)

Interest Rates Are Heading Higher