If you think Britain’s exit from the European Union is going to be a shock to the economy, wait till you see the potential dire straits of Europe’s most vulnerable banks.

I can discuss this topic with precision because today’s the day that our Weiss Ratings division has updated the first-ever, independent and objective safety ratings of the largest global banks in the world.

We are independent because, unlike Moody’s, S&P or Fitch, we accept no compensation whatsoever from the rated institutions. Unlike those Big Three agencies, we also never give the institutions a “preview” of their ratings, never allow them to “appeal” ratings they disagree with, and never suppress publication at their request.

That’s why the U.S. Government Accountability Office (GAO) found that the Weiss Ratings of insurance companies greatly outperformed those of Moody’s, Standard & Poor’s, A.M. Best and others in warning consumers of future failures.

It’s also probably why a study reported in The Wall Street Journal demonstrated that the Weiss Stock Ratings outperformed those of all major Wall Street banks and research organizations.

Average Rating of Eurozone Banks: Absolutely Astounding

We apply these same principles — conflict-free research and accuracy — to our global bank ratings, and here are the big-picture results, based on March 31, 2016 data …

-

Among banks in North America, the average Weiss Safety Rating is C+.On our rating scale, which is similar to school grades, that’s “fair,” a passing grade.

-

In the Asia and Asia/Pacific region, the average rating is C+ (“fair”).

-

And surprisingly, big banks in the Middle East and Africa, despite troubles in certain regions, merit an average grade of B (“good”).

-

But …

In the eurozone countries, the average Weiss Safety Rating of the institutions we cover is D+ (weak) — a red-light warning, especially in the wake of last week’s Brexit vote.

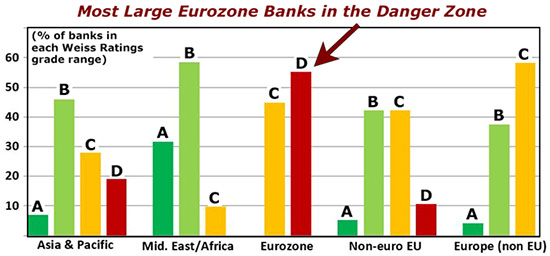

The chart below shows exactly how the grades are distributed among banks outside of the Americas:

The eurozone has the most astounding concentration of large weak banks I’ve ever seen in all the 45 years since I founded my research and ratings company:

Among the banks we cover in the region, 55.3% get a Weiss Safety Rating in the D range (D+, D or D-), while the balance (44.7%) get no better than Cs.

This contrasts with Asia and the Asia-Pacific, where 46% of the institutions are in the B range and only 19% are Ds. And it contrasts even more sharply with the Middle East and Africa where 58.5% are Bs and there are no Ds.

What’s most illuminating of all, however, is the contrasts inside Europe itself:

-

If a bank is based in an EU country that does not use the euro (such as the U.K., Sweden and Poland), it’s less likely to have financial weaknesses than eurozone countries like Spain, Italy, France or even Germany.

-

And if a bank is based in European countries outside of the European Union entirely, such as Switzerland or Norway, it’s even less likely to have problems. (You can see this in the last group of bars in the chart above.)

Evidently, the European Union has not been good for the financial stability of most banks. And the euro currency has been even more damaging.

I repeat: The eurozone has the worst concentration of large, weak banks I’ve seen since we began scrutinizing bank financials back in 1971.

What About Prior Banking Crises?

No, it’s not the first time I’ve seen many banks in the danger zone. In the 1980s, for example, almost one-third of the U.S. banks and S&Ls we rated were in that category. And in the years that followed, 3,700 failed.

Nor is it the first time that megabanks have been vulnerable to failure. In 2007, for instance, we issued D ratings for some of America’s largest … we got frequent flack for our low grades … and later, after they failed, occasional accolades.

Rather, what’s so surprising in this instance is that the AVERAGE grade, including ALL of the institutions in the eurozone that we cover, is so low.

Of course, the preponderance of Ds doesn’t mean that dozens of banks will start failing tomorrow. Nor does it mean that every single one with a bad grade will ultimately go under. But it does signal three things:

-

A higher-than-average probability of failure among large eurozone banks.

-

Systemic, eurozone-wide financial weakness that could cripple Europe’s economy, with far-reaching global consequences.

-

Major vulnerabilities to a political or external shock, such as Brexit.

Why Isn’t This Headline News?

Yes, I know. All the headlines right now are about the Brexit vote. That’s what has lit the fires, stirred the markets and padded media company revenues.

But the Brexit story could eventually die down. This one will not. Quite to the contrary, it could emerge as one of the biggest threats to the global economy, starting from Europe, spreading to Asia, and then to the Americas.

The likely shock waves follow a path that’s similar to what my colleague Larry Edelson has described regarding the future financial difficulties of highly indebted governments: First Europe. Then Japan. And ultimately the United States.

And now, this data reveals a side of the debt pyramid that’s often out of the spotlight, hidden behind inflated ratings, or simply covered up. Our goal is to break through those unfortunate barriers to your knowledge and to give you the tools you need to make prudent, informed decisions for your money.

The 6 Weakest Among Large Eurozone Banks

So let me start by naming some names. Among the largest eurozone banks, here are the six weakest:

All six of these institutions merit a rating of D+ or lower, which we consider to be a danger zone.

All have at least $200 billion in total assets.

And all have multiple reasons for their weaknesses …

Low liquidity, especially in the case of UniCredit SpA, Intesa Sanpaolo SpA, CaixaBank SA and Bankia SA.

Large bad loans almost across the board, except perhaps for Dexia SA.

Poor asset growth, also nearly across the board, with the possible exception of Intesa Sanpaolo SpA and Banco de Sabadell SA. Plus …

Operating losses at one of the six banks — Dexia SA.

So many troubles! And despite a seemingly never-ending series of capital infusions from governments that are, themselves, still mired in excess debts!

Which Eurozone Countries

Have the Weakest Banks?

Five of these six banks are based in Italy and Spain. One is in Belgium.

Meanwhile, most people think that German banks are very strong. But that’s rarely the case.

Deutsche Bank merits a Weiss Safety Rating of only C+; both Commerzbank and Deutsche Postbank get a C-; and IKB Deutsche Industriebank, a D-.

According to the German financial watchdog Bafin, this is especially worrisome in the wake of the Brexit vote. “The biggest banks would have the biggest problems,” says Bafin President Felix Hufeld. “They have the most activities in, and with, London.”

Specifically, Deutsche Bank and Commerzbank are the German banks with the largest business dealings in Britain.

Your Action Plan:

-

Be sure to find out the Weiss Safety Rating of the institutions you rely on to safeguard your money and your finances, including not only banks but also credit unions and insurance companies.

-

Find out which ones are among the safest in your state.

-

If your money is in the danger zone, seriously consider moving it to a safer place. This applies to major regions in trouble like the eurozone as well as individual institutions.

-

Also look up the Weiss Investment Ratings for your stocks, ETFs and mutual funds.

To have all of these resources at your fingertips, plus much more, go here.

Plus, as always, continue to build cash reserves to help prepare for unexpected black swan events that can be very disruptive to global financial markets — and very destructive to your investments.

Best wishes,

Martin D. Weiss, Ph.D.

with Gavin Magor,

Weiss Ratings Senior Analyst