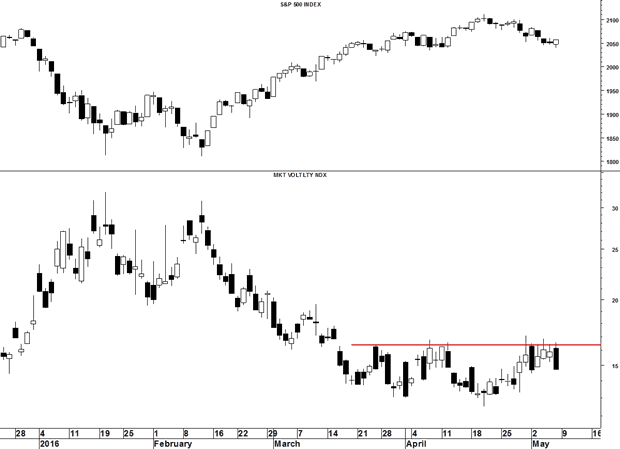

The VIX gave up 0.98 points last week to close at 14.72 after peaking on the expected short-term cycle high on Wednesday. Since March, the VIX has been turned back by resistance at 16.40 several times highlighting the importance of this level. A breakout from 16.40 will be very bearish for equities. Last Friday was an expected 34-day cycle low. The weekly Coppock is very oversold warning of a tradable rally in the VIX (bearish equities).

related: